Le livre est actuellement en rupture de stock

Paramètres

- 112pages

- 4 heures de lecture

En savoir plus sur le livre

The discussion centers on the implications of taxation, particularly how it affects consumption and wealth distribution. It argues that taxing luxuries or necessities can lead to indirect burdens on consumers, especially the wealthy. The text critiques the inconsistency in economic reasoning regarding taxation, highlighting that excessive taxation diminishes both consumer enjoyment and producer profits, ultimately harming the treasury. This analysis reflects on the delicate balance between government revenue and the economic well-being of individuals and businesses.

Achat du livre

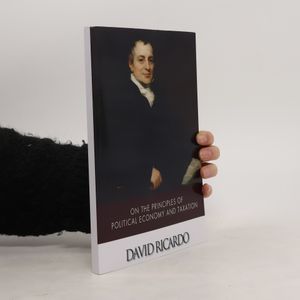

On The Principles of Political Economy, and Taxation, David Ricardo

- Langue

- Année de publication

- 2015

- product-detail.submit-box.info.binding

- (souple)

Nous vous informerons par e-mail dès que nous l’aurons retrouvé.

Modes de paiement

Il manque plus que ton avis ici.